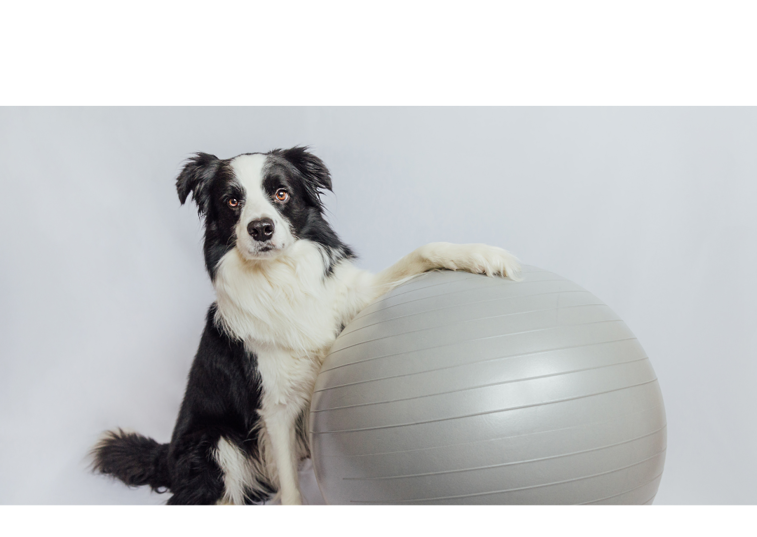

Cat insurance for our feline friends

Embracing life with a cat is a source of joy and countless benefits. They’re our stress relievers, companions, and sleep enhancers.

Our feline friends enrich our lives in so many ways, and when they’re unwell or injured, it can be a cause for concern.

At Purely Pets, our commitment revolves around you and your beloved cat, we understand the unique bond you share. Which is why our insurance is tailored to ensure your cat receives the care they need for a swift recovery. So, they can get back to exploring the garden, savouring their favourite treats, or basking in that special sunny spot in the living room. Your cat’s well-being is our utmost priority, always.

Our Cat insurance cover levels

Opting for pet insurance for your cat is a fantastic choice!

Cat insurance can provide protection against unexpected veterinary expenses for your feline friend. It can help cover the cost of vet bills, including accidents, illnesses, and injuries, ensuring that your cat receives the best possible care without breaking the bank.

At Purely Pets, we offer 15 levels of lifetime cover, allowing you to pick the ideal policy that suits your cats needs and your budget.

Our Defaqto 5 Star Rating applies to our Silver and Gold cover levels providing vet fees of between £6,000-£15,000.

Lifetime Bronze

- Lifetime cover

- Vets fees from £1,000-£5,000

- Flexible Excess Options

Lifetime Silver

- Lifetime cover

- Vets fees from £6,000-£10,000

- Flexible Excess Options

Lifetime Gold

- Lifetime cover

- Vets fees from £11,000-£15,000

- Flexible Excess Options

The Purely Pets Promise

We’re here for you and your cherished pet, every step of the way. From (not so!) perfect puppy and crazy kitten to sweet senior and all those moments in between!

Why choose Purely Pets

What is covered by cat insurance?

When selecting a cat insurance plan for your furry friend, it’s important to consider the following:Cat insurance often covers the cost of vet-related services such as examinations, medications and emergency care which your cat may require in the event of an accident or illness. If you would like to learn more, please review our policy conditions.

In the sad event that your cat passes away due to accident, illness or injury you could be reimbursed up to the purchase price of your pet. For more details, please read our policy wording.

When selecting a cat insurance policy, it is essential to review the details carefully to ensure that the plan provides coverage for the theft of the pet.

With Purely Pets' Silver and Gold Lifetime cover products, you can claim up to £2,000 for advertising costs and a reward for the loss due to theft or straying. However, lower limits are available on the Bronze Lifetime cover.

Boarding fees vary depending on the type of business, location and services provided. Generally, boarding fees included the cost of food, bedding and basic amenities.

Depending on the business, additional services, such as grooming, walks and playtime, may also be included in the total fee. It is important to research the different boarding services available to ensure that you are getting the best value for your money.

Here at Purely Pets, we offer boarding fee cover of up to £2,000 as part of our Gold Lifetime coverage. Boarding fees can only be claimed in certain situations, details of which can be found in the policy wording.

Dental cover typically covers the cost of any necessary treatment related to your pet's teeth, gums and mouth, including the cost of any required medication.

Here at Purely Pets, we cover dental treatment for accident only in year 1 and from year 2 onwards, we also cover dental illness*. For more details, please read our policy wording by clicking here.

With Purely Pets' Silver Lifetime cover products, you can claim up to £2,000 on dental treatment.

*Subject to evidence of annual dental check-ups, and any treatment recommended by the vet has been carried out at your own expense.

What isn’t covered by cat insurance?

A lot of insurers will not cover pre-existing conditions. A pre-existing condition is a medical condition or injury that a cat has shown signs or symptoms of already, prior to your cat insurance policy starting, even if the condition has not yet received a diagnosis.

Neutering is the process of removing a male cat's testes, while spaying is the process of removing a female cat's ovaries and uterus. Neutering and spaying can have many benefits for cats.

It can help reduce aggressive behaviours, reduce the risk of certain diseases, and reduce the number of unwanted cats in the community.

Vaccinations are a series of injections given to cats to help protect them from various diseases, viruses, and infections. Vaccines help to boost a cat’s immune system, allowing them to fight off infections and illnesses that can cause serious and even fatal health problems.

Vaccines are available for a variety of illnesses, including feline leukaemia, rabies, and feline distemper.

Excess is the amount that an insurance policy holder pays towards a claim. The excess can vary depending on the policy chosen and is usually deducted from any claim settlement.

For example, with cat insurance, the policy holder may be required to pay an excess of £140* for each claim. This means that the policy holder will be liable for the first £140 of the claim.

*The excess amount may vary depending on your policy agreement

What type of pet insurance policies can I get?

What you can buy from Purely Pets:Lifetime pet insurance is a type of insurance that offers continuous cover and lifelong protection for your pet, subject to the policy being renewed each year. This type of insurance covers the cost of medical treatments and procedures, such as consultations, surgery, and hospitalisation. Lifetime pet insurance typically includes coverage for illness or injuries that may occur throughout your pet's life, provided the condition has only developed within the period of insurance.

Accident only pet insurance is a type of pet insurance that covers veterinary treatment required for injuries caused by accidents. This type of pet insurance provides coverage for medical bills associated with an accident, including hospitalisation, surgery, lab tests, and medications.

This type of pet insurance provides coverage for a specific amount of time, usually 12 months. When the time limitation begins is dependent on the policy terms of your insurance provider. During this time, your pet is covered for certain types of illnesses and accidents, as well as any necessary treatments. Once the time limit or financial limit has been reached there will no longer be any further cover for that condition.

Maximum benefit pet insurance provides a financial amount per condition, with no time limit subject to the policy being renewed. Once this financial limit has been reached, then there will be no further cover for that condition. Maximum benefit pet insurance may cover accidents, illnesses, surgeries, medication, and more but please refer to your policy terms for full conditions for what’s included in your policy.

Pet advice & news

Are Chihuahuas aggressive?

23/12/24

Chihuahuas can sometimes display aggressive behaviour, but it's essential to know the factors that influence this. By learning more about their unique traits and how to manage any potential aggression, you can ensure a harmonious relationship with your furry friend.

Can cats tell when you're sad?

16/12/24

As pet owners, we often wonder whether our feline companions can truly grasp our emotional states. The question of whether cats know when you're sad has intrigued many, sparking curiosity about the depth of the human-cat bond.

Understanding and managing arthritis in dogs

27/11/24

Canine arthritis, also called osteoarthritis, is a common cause of stiffness and lameness in older dogs (as well as their humans!). Around 80% of dogs over 8 years old have DJD, and 35% of the overall population.

Find out more

You can find out more about our Cat Insurance product below and there’s more help available on our FAQs page.

Cat insurance isn't a legal requirement, but as a responsible pet parent, you should always insure your cat. Even if your feline friend is happy and healthy today, you can never really know when an unexpected illness or injury will happen, which means vet bills could soon start to pile up.

With a cat insurance policy in place, you protect your cat when they need it most by making sure they get the emergency care they deserve. That means no cutting corners when it comes to veterinary treatment and getting your feline back to its best in no time.

Pet insurance may be a good investment for any cat owner. Pet insurance can cover vet visits, surgeries, lab fees, hospitalisation, medication, and other unexpected expenses such as the cost of cremation in the event of your cat passing* (subject to policy wording).

Insurance may help to offset the costs of medical care for your cat, making it easier for you to manage.

While cats are great at taking care of themselves, they cannot avoid certain illnesses and health issues that may be prevalent among felines. Some of these illnesses and health issues include:

Vomiting

Vomiting is a common problem in cats and can be caused by a variety of health issues. It's important to understand the differences between acute and chronic vomiting, as the underlying causes of each can be quite different.

Acute vomiting is usually caused by a dietary indiscretion, such as eating something indigestible, or by an infection. Chronic vomiting can be caused by more serious issues, including an obstruction, pancreatitis, inflammatory bowel disease, or cancer.

In any case, it's always wise to take your cat to the vet if they are vomiting to determine the underlying cause and get the appropriate treatment.

Feline Lower Urinary Tract Diseases (FLUTD)

Feline lower urinary tract diseases (FLUTD) is a common yet serious condition that affects cats. It is caused by a variety of factors, including infections, crystals, stones, and blockages.

Symptoms of FLUTD can include frequent urination, straining to urinate, and bloody urine. If left untreated, FLUTD can lead to serious complications such as infections, bladder rupture, and kidney failure.

Diarrhoea

Diarrhoea is a common digestive disorder that can affect both cats and humans. It is characterised by frequent, loose, watery stools, and can be caused by a variety of factors such as an underlying medical condition, food intolerance, or a bacterial or viral infection.

Diarrhoea can be a serious issue for cats, as it can lead to dehydration and other health problems.

Every feline is different, and there's no one size fits all when it comes to cat insurance policies. When pet owners come to Purely Pets, we base your cat insurance quote on various factors:

-

Your cat's breed

-

The level of lifetime policy you choose

-

The amount of excess you decide to pay

-

Where you live

Yes, the location of where you live can have an effect on the cost of insurance. Insurance premiums are set based on a variety of factors, including the area in which you reside.

To find out more please contact one of our pet insurance specialists for further information on 0330 102 5748 or read our policy wording.

Depending on the type of pet cover you choose, you can be covered for vets bills for accidents, illness, or both up to a fixed monetary amount. Many policies will give you added benefits such as cover for dentistry, loss of pet and overseas travel.

We provide dog insurance & cat insurance- at a variety of different levels to suit yours & your pets needs.

All pet cats in England must now be microchipped or face a fine of up to £500 if you don’t comply.

Whether you’ve just bought a kitten or adopted an older cat, making sure they are microchipped should be top of your list. Microchipping your cat gives them the best chance of being identified and returned to you if they are lost or stolen. Microchips are safe, easy to implant and effective. Unlike collars and ID tags, microchips don’t come off and they don’t put your cat at risk of injury.

Even if you select the most comprehensive lifetime policy for your pet, it still may not cover pre-existing conditions. This includes any illness or injury your cat has or shows signs of developing before you take our insurance.

Pet insurance doesn’t normally cover you for any conditions that already exist before you purchase, so always check this if are looking to move to a new provider or if you are taking out insurance for the first time but your pet has pre-existing medical conditions.

There will also generally be an excess (a fixed amount that you contribute to any claim) or a co-payment excess (normally a percentage of the total claimed amount that you will contribute to any claim) on your policy that you will have to pay.

Other common exclusions for pet insurance are cover for elective, routine or cosmetic treatment and cover for illness or accidents within a specified waiting period.

Having a pet is a long-term commitment which is why we offer three different levels of lifetime coverage for your dog or cat.

Lifetime insurance for your cat will provide coverage (upon approval) for your beloved companion for the duration of their lifetime, as long as the policy is renewed each year – just as the name suggests!

Here are some of the types of cat insurance policies available and what they all mean:

Lifetime insurance

These policies provide cover for the life of your pet and offer comprehensive coverage. They include cover for veterinary fees, third party liability, death from illness, death from accident, and more.

They may also offer additional benefits such as access to 24/7 vet video consultations or travel cover.

Here at Purely Pets, we love cats just as much as you do, and want to make sure they get the cover they deserve. That's why we only offer lifetime protection.

If you would like to talk to one our pet insurance policy specialists, you can get in touch with us on 0330 102 5748 to find out more about our cat insurance policies or to find out more about making hassle-free claims with Purely Pets.

Maximum benefit policies

With maximum benefit plans, you get a predetermined amount of funds for each medical issue that arises with your pet, and these funds will keep being used for treatments until the money is completely used up.

Once this limit is reached, there is no further cover for that condition.

Time-limited

Time-limited pet insurance policies will usually provide a fixed amount to pay for the treatment of any sickness or injury your pet may suffer from.

It will also come with a designated length of time for which this treatment will be covered - typically 12 months from the start of the illness or injury, or from the first date of treatment, as long as the policy is still active.

The time limit doesn't refer to the total duration of the policy, but the maximum amount of time that any given illness or injury will be covered for.

Accident only policies

Accident-specific policies provide a fixed amount to cover the medical expenses related to accidental injury sustained by your pet. However, any accidents that occurred prior to the policy's commencement will not be eligible for coverage.

These policies offer cover for accidents and illnesses for the pet’s lifetime. This is dependent upon you renewing the policy each year and keeping up to date with premiums. These are usually the most expensive policies, because they provide the most comprehensive cover.

All of our Lifetime policies offer you a pot of money per year that can cover accidents and illnesses. We only offer Lifetime cover to our customers as we believe it is the most comprehensive cover available.

Like humans, our pets are more likely to be affected by illness as they get older. This means that every year your insurance premium will increase even if you haven’t made a claim. This increase will be significant if you have claimed.

If you have a cat of a certain age, it can be tough to find pet insurance. At Purely Pets, we believe every animal deserves the best, no matter your cat's age.

That's why all our lifetime veterinary cover policies have no upper age limit – we'll protect your cat whether they are 8 weeks old or a senior.

Yes, multiple pets can be insured and their policies can be linked but each pet will have their own benefit limits. Therefore, any claims that may happen will not impact the other pet's policy.

To get a quote from Purely Pets and protect your cat, we'll need to know your pet's:

-

Age

-

Gender

-

Whether they've been microchipped

We also have a specialist Pet Insurance team that you can call to get a quote or discuss your options in more detail.

Call to get a quote on 0330 102 5748 or discuss your options in more details. Alternatively, click here to get a quote online.